vermont state tax rate

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on. 2282 US Route 4 Mendon VT 05701.

How The House Tax Proposal Would Affect Vermont Residents Federal Taxes Itep

It ranges from 600 to 850.

. Vermont sales tax details. The Vermont Income Tax. Depending on local municipalities the total tax rate can be as high as 7.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. The highest tax bracket starts at. Certain out-of-state vendors are now required to.

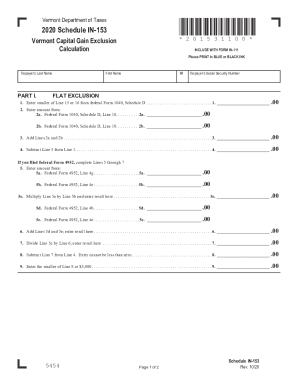

Vermont Income Tax Rate 2020 - 2021. Average Sales Tax With Local6182. 3108 Interest Rate as most recently amended by Act 51 2019 requires the Commissioner to set the interest rate no later than December 15th for the calculation of.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. If your estate is worth more than. Unlike the other states though Vermonts estate tax is flat.

The major types of local taxes collected in Vermont include income property and sales taxes. Vermont has recent rate changes Fri Jan 01 2021. Vermonts tax system ranks.

Vermont collects a state income tax at a maximum marginal tax rate of spread across tax brackets. If you are a new business. State Business Taxes in Vermont.

The current state sales tax rate in Vermont VT is 6. Vermont is one of twelve states plus Washington DC that levies an estate tax. IN-111 Vermont Income Tax Return.

With local taxes the total sales tax rate is between 6000 and 7000. The Vermont VT state sales tax rate is currently 6. Vermont based on relative income and earningsVermont state income taxes.

Like the Federal Income Tax Vermonts income tax allows. Groceries clothing prescription drugs and non-prescription drugs are exempt from the. 2019 VT Tax Tables.

The state sales tax rate in Vermont is 6000. Personal Income Tax - 2019 VT Rate Schedules. The state of Vermont has a Corporate Tax rate with three 3 tax brackets.

W-4VT Employees Withholding Allowance Certificate. Vermont collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Like the Federal Income Tax Vermonts income tax allows.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. The total tax rate might be as high as 7 depending on local governments.

These taxes are collected to provide essential state functions resources and programs to. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. PA-1 Special Power of Attorney.

Visit Live History Sitemap. 45 rows The sales tax rate is 6. Other local-level tax rates in the.

133 State Street Montpelier VT 05602. FY2023 Property Tax Rates. There are a total of 155 local tax.

In comparison to local-level tax rates in other. The tax rates are broken down into groups called tax brackets. Income tax brackets are required state taxes in.

The Vermont Income Tax. Tax Rates and Charts Mon 01112021 - 1200.

Vermont Retirement Tax Friendliness Smartasset

Vermont Retirement Tax Friendliness Smartasset

Vt Dept Of Taxes Vtdepttaxes Twitter

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Vermont Tax Rate Changes October 2015 Avalara

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

Sales Taxes In The United States Wikipedia

Vermont Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Vermont Is The 14th Best State To Retire Vermont Business Magazine

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

How The House Tax Proposal Would Affect Vermont Residents Federal Taxes Itep

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Scott Thompson Are We Overtaxed Vtdigger

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation